This is the continuation of the article: Private Funding of Renewable Energy

Key Features of Funds Providing Equity (Part 5)

Venture Capital, non-public Equity and Funds (Part 4)

The monetary Institutions– what they are doing (Part 3)

Introduction – Finance basics (Part 2)

Private Funding of Renewable Energy (Intro)

This section illustrates, what financiers consider when

investing in RE assets on the ground; this would typically be the case in a

project finance, fund and private equity context. There are a range of

variables that impact project success and many that will change over the

project lifespan: these need to be understood and managed or mitigated. Prior

to investing both debt and equity providers will undertake a detailed assessment

of these risk factors, which is known as due diligence. Technical experts and

advisers will be brought in during this process, where specific technical knowledge

or insight is needed. This is where RE and energy policy fit in, as covered in

more detail below.

Typical risk assessment will include:

Country and Financial Risks

• Country risk – this is a broad term and covers a range of

economic and political risks including government stability, status and

maturity of the legal system, transparency of business dealings and currency

risks. It also includes general instability due to wars, famine and strikes.

• Economic risks – inflation, local regulation.

• Financial risks – interest rates4, refinancing risk,

insurance (business interruption, asset rebuild), asset liquidity.

• Currency risks – exchange rate risks, currency controls,

devaluation. Exchange rate risk, for example, is faced by investors in emerging

markets if revenue is generated in local currency and loans are to be serviced

in hard currencies. In this situation, the lenders are likely to require the

project to ‘hedge’ the risk using a financial contract, but in many emerging

countries these contracts can be expensive and for short durations. Equally, a

UK or US investor buying plant or equipment in Euros finds project costs rise

as a result of the falling sterling-euro or dollar-euro exchange rate. Often

purchasers will arrange a concurrent currency hedge with the supplier or a bank

at the time the supply contract is signed to manage this risk for an individual

project.

• Political risk – this incorporates not only the stability

and durability of political regimes but also the risk that for example tax laws

are suddenly changed, central bank rates are increased etc. directly affecting

project viability. Policy and regulatory risk are subsets of political risk.

• Security risks – can the lender actually take possession

of a plant if there is a default on the loan, and will it be permitted to

operate the plant and maintain the revenue generation? Although in most

developed countries the right to security over an asset has a solid legal

basis, this is not always the case in some emerging markets and can add

significant complications.

Policy and Regulatory risk

As the policy or incentive mechanism may be a key part of

making RE project economics attractive, changes to these factors pose a risk: a

long-term, stable policy regime with a sound legal basis is essential for serious

investment to occur. Regulatory risk is also considered in depth for the

permits, authorisations and licences required to plan, construct, operate and

decommission RE projects. A sound track record of stable and consistent

regulation, well managed price or other reviews, and clarity over the

development of regulations or policy to implement new RE legislation, would be

sought. This is covered in more detail in the section below.

Technical and Project Specific Risk

Typically this will include a review of the technology, its

suitability for the proposed conditions, operational track record, source and

accessibility of spares, a feedstock/energy resource assessment and a capital

expenditure cost review for a construction project. These factors are generally

assessed by a technical expert on behalf of lenders and investors.

• Construction risk – this will cover the risks involved

with the build, the interfacing of different contracts, the degree of

protection from liquidated damages for project delays, other damages, build

timing.

• Technological risk – each RE technology will be assessed

in the light of its maturity, operating history, fitness for purpose and

warranties. The assessment will be undertaken by appropriate specialists often

working closely with the technology supplier.

• Environmental risk – environmental and social risks

associated with the project, often subject to legal requirement for an impact

assessment.

• O peration and Management risk – once a project has been

commissioned the plant will need to be properly maintained and staffed to

ensure optimal performance. An assessment will be made of staffing and costs, as

well as contracts required during the operational period and provisions required

for decommissioning.

Market Risk

These assessments are typically provided by market

specialists who report on topics including future electricity prices, future

green subsidy prices, future carbon prices, and the prospect of new

competitors.

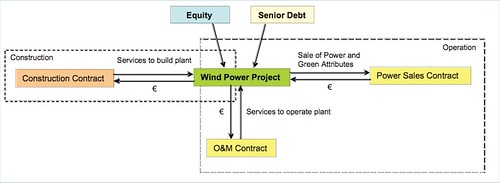

The boxes below show finance and contractual arrangements

for a wind power and biofuels project. These illustrate differences in the RE

subsectors, and the kinds of issues financiers will examine.

Box 2. Structure of an Operational Wind Power Project

This diagram sets out the typical contractual structure for

a wind power project. Technical studies of the wind resource, a review of the

proposed technology and the construction, operations and maintenance will have

been completed. The construction contract may well feature multiple contracts,

in which case detailed analysis of how the contracts interact will be

completed. Legal due diligence including all land title will be reviewed. If

the project is only viable due to the power and green attributes it sells, a

thorough review of the offtake contract and subsidy regime will be performed.

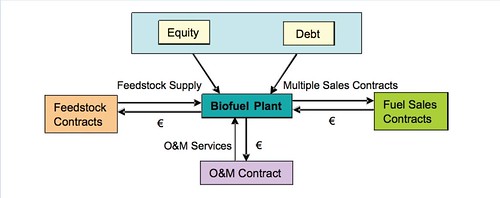

Box 3. Structure of a Biofuel Plant

This example of a biofuel project highlights some challenges

project promoters often face, not including policy risks linked to the

sustainability of feedstock.

Issues include:

• Stable feedstock supply: if multiple contracts with

suppliers are involved the actual ability of the plant to produce the biofuel

at a forecast production capacity carries a greater risk.

• Sales contracts: on the output side, producers will want

to find sales contracts for biofuels that line up with long term project

finance debt. This can be challenging.

• Lack of correlation between the prices for the feedstock

and the final product being sold (associated with the commodity markets and the

oil markets respectively). This can mean that the biofuel plant can be squeezed

in between two separate markets.

Please don't forget to check our website ecogreen4us.com for more eco & green products and services

Your green Technology world is really appreciable.

ReplyDeletei like your blog and also recommended a technology website where you find latest updates over internet.thanks