- Venture Capital Funds

• Money raised from a wide range of sources with high risk

appetite to include insurance companies, pension funds, mutual funds, high net

worth individuals

• Target new technology, new markets

• Interested in early-stage companies

• High risk of failure in every venture

• Investment horizon around 4-7 years

• Return requirement, many multiples of original investment

(50 – 500% IRR)

- Private Equity Funds

• Money raised from a wide range of sources with medium risk

appetite to include institutional investors and high net worth individuals

• Target opportunities with possibility for enhanced returns

(or ‘upside’)

• Interested in companies and projects with more mature

technology, including those preparing to raise capital on public stock

exchanges (‘pre IPO’), demonstrator companies, or under-performing public

companies.

• Shorter investment horizon, 3-5 years

• Higher return requirement, 25% IRR

- Infrastructure Funds

• Funds drawn from a range of institutional investors and

pension funds

• Target ‘infrastructure’ i.e. an essential asset, long

duration, steady low risk cash flow

• Interested in roads, railways, power generating facilities

• Medium term investment 7-10 years

• Low risk and return, 15 % IRR

-Pension Funds

• Typical investments include:

- Public equity (via stock markets)

- Corporate and government bonds

- Real estate

- Inflation-linked assets (such as commodities, inflation

linked bonds, infrastructure

and energy, forest land)

- Private equity

- Cash and cash equivalents

• Investing directly they seek ‘cash yielding’ investments,

i.e. those that generate a stream of cash year on year, as opposed to an

investment in which all cash is realised at the end of the investment period through

an ‘exit’ (by either sale or IPO). These investments are required to support

their long term liabilities;

• For these investments they display a low risk appetite,

reflected in expectations of stable returns at around the 15% level;

• In RE they make very low risk investments e.g. a portfolio

of operational onshore wind assets;

• As they have very large funds to invest, they do not

commonly get involved in individual projects. They may allocate monies to

specialised Private Equity or Venture Capital funds (including infrastructure

or renewable energy funds) that manage the investments and provide the pension

funds with a return;

• A handful of specialised RE bonds have been issued which

have been of interest to pension funds. Risks are described in the project bond

issue documents.

Project risks will be extensively mitigated (such as reserve

facilities, for example for maintenance problems, distribution restrictions,

cash sweeps) in order for the project to attract “an investment grade rating”3

making it attractive to investors (a higher rating suggests less risk that the

project will default on its bond obligations leaving bond investors at risk of

not being repaid).

Note that there is some overlap between the categories, for

example, infrastructure units within some Banks, Pension Funds, and

Infrastructure Funds.

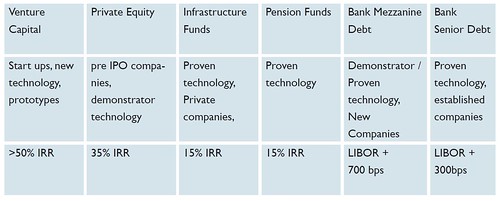

The box below illustrates the types of financing likely to

be involved at different stages of new technology development – from the point

at which it comes out of the laboratory (or equivalent) to readiness for

commercial roll out as proven technology, after which banks, private equity and

other funds will become interested.

Box 1. Building the Supply Chain : Finance for Early Stage Technology

Investment e.g. Wave Power

This example demonstrates the phases of investment from

public grants, VC funding and production subsidies required to develop a new RE

technology through to the point it can begin to demonstrate a track record and

attract second stage funding. This might be through an Initial Public Offering

(IPO) on a stock exchange to raise equity from external investors, as well as

project finance debt from banks, to enable further project build out. The term,

the ‘valley of death’ is often used during the phase illustrated above which

describes the difficulties of accessing commercial finance between the initial

VC investment and demonstration; or from demonstration to commercial roll-out

with secondary VC investment.

The diagram shows where public grants or specific subsidies

can be essential. In its final stages of development where a technology steps

into ‘Proven Technology’, it is then assumed to be fully commercial and to

compete with other forms of RE, when standard grants, support or incentive mechanisms

or other subsidies will become available. Investors such as private equity

firms are likely to be attracted at this point, although there are overlaps

between stages and financial institutions.

Please don't forget to check our website ecogreen4us.com for more eco & green products and services

No comments:

Post a Comment